Welcome to Our 1-Year-To-Go Plan!

Follow Us!

1-Year-To-Go Model Plan

Please Consult your Financial Advisor for all financial decisions hypothesized in this plan. We are NOT qualified Financial Advisors. The plans developed simply represent an approximation of the plans we developed for our own full-time travel needs. Hacking the Road does not warrant or guarantee success.

Ok, so you're almost ready to take the leap and join all the Road Hackers across this wonderful world. This plan assumes you only have one year to go before you hit the road. Congratulations! You've done the hard work squaring away your finances.

Our 1-Year-To-Go Plan will help you make the final tweaks. The plan provides budget examples, final checklists, and discusses innovative Budget 101 Hacks that will better position your finances for longterm travel.

For those of you finishing your 4th year of the 5-Years-To-Go Plan, the following format will be very familiar. You are ready to make the transition to the final prep year! Your patience is paying off!

For those not familiar with our process, please bear with us. The following sections will bring you up to speed step-by-step.

Let's Start with the Model Assumptions & Build a Budget!

For those not familiar with our planning process, here's a quick orientation on our model plan. The 1-Year-To-Go Plan is specifically focused on the transitions that must take place during the last 12 months before you launch your Life on the Road.

We start with a few basic assumptions and show you how we build an ideal transition plan. The model assumptions will most likely not fit your situation perfectly. Your job is to use this model to develop a customized plan that will accommodate your own realities and goals.

The model will provide an organized way to analyze your situation and build out your own action plans and targets. This is simply a framework for your reference and can be a powerful tool in your arsenal.

Baseline Model Assumptions Starting Today:

Don't worry if your finances don't match the above targets. This is just a model. You're in the ballpark as long as you have combined assets of approximately $350,000, combined take-home pay of approximately $90,000, and very little debt. You should be able to add a significant amount to this base over the next 12 months.

The goal is to have sufficient funds to set you up for the first 5 years of travel.

In Case You're More Visual, Here It Is!

Model Baseline Starting Point

Starting Investments/401 K

Credit & Car Debt

Starting Home Equity

Student Loan Debt

Starting Savings

Net Asset Position

So, Let's Get Familiar with Your Goals for the Next Year!

1-Year-To-Go Plan Goals

Given the above assumptions on baseline assets and debt, our target goals at the end of this year are as follows:

For some, these goals will be a stretch. If this is your situation, consider increasing your time horizon before launch. You may want to develop a modified 2- or 3-year plan that suits your circumstances. Review our 5-Years-To-Go Plan for further guidance.

Many of you may have already exceeded these goals. Nicely done! Your task will be to focus on all the transitions needed to have success as a full-time Road Hacker!

Either way, a disciplined approach to building wealth and managing your assets is critical to your long-term success.

Check out our Budget 101 Hacks section (below) for amazing strategies to make this happen. Implementing many of these hacks will get you on the right track.

Be sure to consult your Financial Advisor before making these decisions.

Again, in Case You're Visual, This Might Make More Sense!

1-Year-To-Go Plan Goals

Investments/401K Goal

Credit & Car Debt Goal

Home Equity Goal

Student Loan Debt Goal

Savings Goal

Net Asset Position Goal

Ok, Let's Close These Gaps and Reach Our Goals

Budget Goals with Targeted Progress

Please note that the following calculations are rough estimates only. These numbers provide general guidance on possible scenarios that may be helpful as you put together your own 1-Year-To-Go Plan.

In order to reach your final goals and close the gaps (as outlined above), here are the action steps for the next 12 months:

How About a Few Strategies That Will Make This Easier!

Applying Our Budget 101 Hacks

Please be sure to consult your Financial Advisor and/or your Health Professional in all matters affecting finances and/or your health. Circumstances and realities vary significantly from person to person. The following strategies simply represent goals and strategies we have developed based on our own experiences.

Hackers on the Road has assembled a list of Budget 101 Hacks that can easily be applied as you develop your 1-Year-To-Go Plan.

The following section will outline these hacks and provide resources for your due diligence.

The hacks will not necessarily all apply in your situation. Your job is to review the hacks and find ways to integrate the best ones into your final plan. This strategy will help you to more aggressively go after your goals.

Each hack shows the potential savings over the next 12 months. Keep in mind, many these savings will continue while you're on the road.

#1. Pay Down Non-Mortgage Interest

Eliminate all high-interest debt--highest first. Credit cards, installment debt, and retail credit are all examples of high interest obligations. Set your target date for your full-time travel and plan to pay off all high interest debt by that date. The average American pays $280,000 in interest over a lifetime. Average non-mortgage debt in the U.S is about $27,000. Average credit card rates are 20%+, student loans average 4%.

Total Savings up to $2,000 over the next 12 months

#2. Down-Size Home Size

Downsize your home, reduce your mortgage payment. The median price of a new U.S. home is approximately $284,000, with a monthly mortgage payment of $1,750 (including PMI). The average home size is about 2,500 sq ft. Interest paid over 30 years would be about $200,000 (4% rate). Reducing home size to 1800 sq ft will reduce the monthly payment by approximately $450 per month.

Total Potential Earnings up to $5,400 over the next 12 months

#3. Cut the TV-Viewing Cord

Change how you view television and save $$. Cord cutting gets easier and easier. Alternatives to most programming are available through an increasing number of streaming vendors. The average American family pays about $75 for cable or satellite TV. An impressive package of streaming subscriptions including Netflix, Amazon Prime, Paramount+ (CBS), Disney+, and ESPN+ would cost approximately $50 per month.

Total Savings up to $540 over the next 12 months

#4. Don't Overpay for Internet

Save on home internet costs. We all need access to a reliable internet connection, but it doesn't need to cost a fortune. The average American pays $60 -$80 per month--half the population pays more. The key to saving here is to actively manage your account. Shop around for promotions and check your bill for extra charges. Most of us are overpaying for speeds we don't need. 100Mbps is just fine for most. Save at least $10 per month by owning your own router-modem.

Total Potential Savings up to $240 over the next 12 months

#5. Get Cell Phone Bill Under Control

Cell phone bills are out of control, but they can be controlled. The average American family pays about $115 per month for cell phone plans. The following strategies can be used to reduce this liability: Try to keep your smart phone for at least 3 years; shop around for promotions; get rid of extra charges on your account; get senior and/or military discounts; check out Mint Mobile, Google Fi, Reach Mobile, and/or Pure Talk for savings of at least $50 per month.

Total Potential Savings up to $600 over the next 12 months

#6. Don't Trade in That Car

Buy a reliable second-hand car, maintain it, and keep it! Most people make the mistake of trading in their vehicle too soon. The average American keeps their car for 6 years, owes $4,600 at trade in, and always has a car payment. That liability is a huge contributor to consumer debt. The average monthly car payment is about $450. Keeping your car for 15 years can really add up to significant savings--and investing those savings will compound the benefit. Buy a solid Toyota, Honda, Nissan, or Subaru.

Total Savings up to $5,400 over the next 12 months

#7. Technology Can Cost Less

Buy quality technology, buy refurbished, and keep your gadgets longer. Check Consumer Reports and buy reliable technology. Buying refurbished can save about 30% compared to new. Take a look at Back Market, Amazon, and Walmart for deals. Keeping your smart phones and computers for an extra year can further reduce your average annual tech cost by another 30%.Most couples have at least 2 cell phones, 2 laptops, and 1 tablet. That's big savings!

Total Potential Savings up to $300 over the next 12 months

#8. Savings Should Work 24/7

If your savings aren't working, you're not saving. The average American has approximately $5,500 in cash, checking, and money market funds. Very few realize much of a return on this money. We have used Worthy Bonds to park these funds at a very generous 5% (recently increased to 5.5%) annualized return. Best of all, the Worthy App is easy to use and provides daily interest updates. Another benefit is that your funds can be available more or less within a week when needed.

Total Potential Savings up to $300 over the next 12 months

#9. Long Term Passive Investment Strategies Work

Buy a passive S&P Index Fund (SPY) to take advantage of impressive longterm growth averages! The S&P has averaged 7%+ appreciation annually since the 1920s. The key to this strategy is a time horizon of at least 10 years. Gains and losses tend to come in big spurts and collapses. Over time, the upward trend line has held. The S&P is up an average of over 8% per year since December 1999. Over 20 years, the average equity investor underperforms the S&P by about 4.5%. For our Net Gain calculation, let's assume the average 50-year old has $135,000 invested.

Total Net Gain up to $6,000 over the next 12 months

#10. Long Term Active Dividend Growth Investment

For the more adventurous longterm investor, a dividend growth strategy may be more attractive. What if you could get both portfolio appreciation and a steady stream of annual income? The DivGro 2.0 website shows how they have actively managed such a portfolio over the last 9+ years. Their active strategy has yielded an annualized return of over 26% through 2021! All income is reinvested. DivGro 2.0 has outperformed annualized S&P returns by a whopping 17% over the same period. A subscription may be required. The 1-year net gain below compares the performance of the average investor with an average $135,000 portfolio at age 50.

Total Net Gain $20,000+ over the next 12 months

#11. Shop Home and Car Insurance

Conduct an audit on your home and car insurance, actively shop for savings, bundle to save more. Stay on top of your home and auto insurance costs. Annually shop around for the best rates. Bundling both home and auto insurance with the same insurer tends to yield the best result. The average American saves 17% with this strategy. Pay upfront for the year to save another 5%.

Total Potential Savings up to $700 over the next 12 months

#12. Skip the Convenience of Starbucks and Dunkin' Donuts

Kick the coffee & snack quick fix at Starbucks and Dunkin Donuts, it's costing you a fortune! The average American conservatively spends about $4 each week day at Starbucks and/or Dunkin' Donuts. Enough said, you know you do! With a little planning, you can easily satisfy your habit by brewing at home and purchasing K-Cups for the office. Use free holiday and birthday gift cards when you really have to go.

Total Potential Savings up to $1,000 over the next 12 months

#13. Avoid the Soda Habit at Restaurants

Drink your Soda at Home, not at the Restaurant. A nice cold glass of water with a refreshing slice of lemon more than replaces the unhealthy sugary soda drinks offered by most restaurants. The average American couple eats out at least once each week. The average restaurant soda costs about $2.50 per order. That can be as much as 16% of the total order.

Total Potential Savings up to $300 over the next 12 months

#14. Outsmart the Alcohol Trap at Restaurants

Stay away from ordering alcohol at restaurants and reward yourself later. Alcohol sales represent a huge mark-up opportunity for restaurants. The average restaurant alcohol order can easily be 25-30% of the total bill. The average couple could conservatively spend $15 per outing once a week.

Total Potential Savings up to $800 over the next 12 months

#15. Fewer Restaurant Visits, More Home Cooking

Learn to make pizza or cook that steak at home, it's fun! The average home-cooked meal cost approximately $4 to prepare. The average restaurant meal conservatively costs about $14 without tax and tip. Besides, home-cooked meals are substantially healthier, with less salt, fat, and sugars--a win-win. The average couple has a restaurant sit-down meal at least once per week. Eating out once each month adds up to big savings! Don't forget Groupon and Restaurant.com!

Total Potential Savings up to $1,400 over the next 12 months

#16. Take Full Advantage of Employer 401-K Matching Contributions

Max out your 401-K contributions when employers match contributions. Many employers offer a 401-K matching contribution for every dollar you contribute up to a certain percentage (3% of salary is common). The median annual salary in the U.S. is about $70,000. At this rate, employees stand to gain an extra $2,100 per year in tax-deferred savings. Compounded over a career, this represents a sizable contribution to your nest egg.

Total Extra Potential Savings up to $2,100 over the next 12 months

#17. Don't Overpay for Storage

Audit your storage needs every year. We've all been there. Maybe we'll need this, maybe we'll need that. Better keep it! Next thing, we're paying for storage. Key: Never pay for a storage unit bigger than you need, and honestly evaluate whether you really need one at all. You can buy new stuff with the money you save. Step one, make some tough decisions--sell, donate, trash, keep. Sell things you don't need, donate the things you don't sell, trash the junk, keep your essentials. Downsizing from a 10 ft x10 ft to a 10 ft x 5ft locker easily saves $40 a month. Pay upfront for 12 months and save another 8%.

Total Potential Savings up to $480 over the next 12 months

#18. Sell That Extra Car

If you don't regularly use that extra car, you don't need it! An extra car is a money pit. You are obligated to maintain it, pay for insurance, and pay for registration. Why not turn it into cash. Besides, it takes up a lot of room. The average American family own 3+ cars. Consider car-pooling, the occasional Uber or Lyft, or cycling to cut down on your car needs.

Total Potential Savings up to $1,600 over the next 12 months

#19. Turn Home Furnishings, Clothing, Appliances into Cash

Cash is King! Sell and consign your used clothing, furniture, and home appliances. Yard sales and consignment stores are common these days. We've all collected and hoarded things for years. It's time to liquidate and get that money working for you. There's a movement out there that really values retro. Take your best items over to a reputable consignment store or sell through Poshmark or ThreadUp--you'll get top dollar that way. Get to know your local yard sale schedule and plan to have 2 sales a year to clean up your clutter. Donate the leftovers. You'll be surprised how much you make.

Total Potential Earnings up to $800 over the next 12 months

#20. Get That Dreaded Side Hustle Going

Side hustles abound, pick one that suits your schedule and talents. There are so many convenient side hustles today. COVID has single-handedly main-streamed remote working as a viable option for millions around the world. The options are boundless. ETSY is there for the artists and artisans, Ebay and Amazon provide robust marketplaces for all kinds of merchandising, and then there are all the free-lance sites like Upwork and Fiverr for remote project-based work. You could try your hand at Airbnb or Vrbo, or get certified to teach English as a Second Language for online tutoring.

Total Potential Earnings up to $5,000 over the next 12 months

I can't stand any more savings! Make it stop! But, no ...

#21. Become a Grocery Shopping Guru

Become an expert grocery shopper by studying flyers, clipping coupons, and shopping multiple stores. There are big savings here if you are willing to put in the upfront time. Once a week, mail boxes are flooded with grocery flyers and coupons. The Sunday paper is a good source for major coupons. Online coupons can be found at SmartSource.com. Develop a list of your regular staples. Plot your weekly shop with your flyers and coupons in mind. We maximize our savings by shopping at Aldi (similar to Lidl), Walmart, and Sam's Club (similar to Costco). The USDA's Moderate Cost Plan estimates monthly grocery costs at $625 per couple. A skilled shopper can save almost 30% off that total.

Total Potential Savings up to $2,000 over the next 12 months

#22. Reject the Landline Offer

Reject cable or satellite packages offering to bundle their services with a landline. If you have a landline, ask to have it removed from your bill. Landlines are still in favor with those concerned about cell phone reliability during a crisis (weather especially). You will need to decide whether this $25-$35 per month expense is worth the extra peace of mind.

Total Potential Earnings up to $360 over the next 12 months

#23. Don't Spend Tax Refunds

Have the IRS direct deposit your refund and save the full amount. The average American receives a tax refund of approximately $2,800 each year. Unfortunately, this check is mostly seen as a windfall and quickly spent. $2,800 invested (5%) each year over a 40-year career results in a sizable nest egg of about $350,000.

Total Potential Earnings up to $3,000 over the next 12 months

#24. Don't Spend Annual Raises

Stay disciplined, stick to your inflation-adjusted budget, and save at least half of your annual raise. The average American receives a 3-5% annual raise when the economy is in good shape. This is not found-money or a windfall. This is an opportunity to shrink your timeline to independence. Auto-deposit half your raise into a savings account (Worthy Bonds)--or use it to pay down debt.

Total Potential Savings up to $2,000 over the next 12 months

#25. Consider a Warren Buffet Mindset

Warren Buffet's success is no accident. Warren buys undervalued assets, holds them for the longterm, and liquidates when his goals are met. There is no reason this strategy can't be implemented in your portfolio. The longterm extremes of market cycles in the Oil & Energy Industry represent significant opportunities for investors with patience and long horizons.

The play here is to buy 5%+ dividend paying midstream Oil & Energy stocks when the per-barrel cost of oil falls below $40, and then sell when oil hits $70. This opportunity has surfaced 3 times since 2001: Oct 2001-Sept 2004; Jan 2016-January 2018; and March 2020-Jun 2021.

Assume an investment of $50,000 with 3 opportunities over the last 20 years. While you wait for the big pay-off, the dividends will keep you flush--take a look at KMI, EPD, ET, TRP, and ENB. Before 2000, the cycles were longer, but the emergence of China and India have changed the market dynamic.

Total Potential Average Earnings Depends on Opportunity being Available

#26. Consider Thrift Outlets for Great Clothing and Apparel Savings

Goodwill, ThredUp, Poshmark, and other resale merchants should be a part of your wardrobe. Sustainable resale is cool now! According to ThredUp, 33 million people bought thrift resale for the first time in 2020--and 76% expect to continue this new habit. On average, Thrifters are buying 7 thrift pieces that they would normally purchase new. A significant number of people spend more than a $1,000 per year in this category. Thrifts offer discounts of over 50% across the board.

Total Potential Savings up to $500 over the next 12 months

#27. Stretch Your Entertainment Dollar to the Max

Entertainment is critical to our sanity, but it doesn't need to cost a lot. The average American adult spends about $3,000 on entertainment annually. Try to cut that in half! If you must go to the movies, attend a matinee, go Monday through Thursday, or find a low budget theater. Better yet, stream recent movies at home and make an evening of it for the family! Start following the local high school sports teams. If you must go out for drinks, choose Happy Hour and limit yourself to once per month. Organize a monthly potluck dinner that rotates among your friends. Find free concerts. If you love the casino slots, find machines that have lower denominations and be disciplined with a set budget. It all adds up!

Total Potential Savings up to $1,500 over the next 12 months

#28. Change the Way You Vacation

Be strategic in the way you vacation. The average American couple spends about $3,000 on vacations each year. Most of us live within a day's drive of amazing destinations. Reduce the number of vacations where airfare and a rental car are required. Some of that savings can be used to do more and stay at nicer places.

Check out Airbnb, Vrbo, Booking.com, Expedia, and Hotel Tonight for the best deals. Book lodging that has a kitchen or free breakfast. Sometimes booking 15-20 miles away is much cheaper. Consider home swapping via Home Exchange or Love Home Swap to save on accommodation and transport. Use smart search engines for cheaper flights. Agoda and Skiplagged are consistently good. Try Kayak and Google Flights for multi-city flights. Always check Southwest, Ryan Air, Volaris, and Easy Jet. They are not included in most searches! Make sure you earn and use your frequent flyer miles.

Total Potential Savings up to $1,500 over the next 12 months

#29. Take Control of Your Healthcare Costs

Beyond major medical necessities, most healthcare expenditures are discretionary. In other words they are controllable. Many doctor's visits can be completed via Telehealth at $30 - $40 per visit--cheaper than the co-pay with your insurance.

Make sure your medical professional writes a prescription allowing the generic version of the medication. The average brand drug costs about $96 vs $28 a month for the generic version. A 3-month supply can also reduce the monthly average cost. Shop for the best prescription prices and check out GoodRx.

Always stay in-network for all medical procedures to avoid unexpected bills.

Take a good multi-vitamin and exercise! Consider Urgent Care instead of the Emergency Room for minor concerns--reduced out-of-pocket, and less time.

Re-evaluate your Dental and Vision plans. Are they really saving you money? Research the actual out-of-pocket prices of dental and vision care with what you are currently paying in annual insurance payments.

The vision care industry has been disrupted recently, making vision care much cheaper. Increasingly, people are buying their lenses and frames online through Warby Parker, GlassesUSA, and EyeBuyDirect. Eye exams are about $75 at Walmart and JC Penney.

Total Potential Savings on Insurance up to $1,000 over the next 12 months

#30. Take the Senior Discount!

Assuming you are older than 50, you're eligible for special treatment. Many discount programs start earlier than most people think. Don't be embarrassed to take the discount, you earned it!

Step one, go to theseniorlist.com to see the full array of major discounts currently available. Most restaurants offer a 10% discount for age 60+. Denny's stands out, offering a 15% discount to AARP members. Uno Pizzeria offers a 25% discount on Wednesdays.

Retail savings are also available. Walgreens offers 20% off once per month. Ross, Goodwill, Bealls, DressBarn, and TJ Max all offer at least 10% on certain days of the week. The AARP Prescription Discount Card is a must.

Budget and Alamo car rental offer 10-25% discounts. Hyatt has the most aggressive discount in the hotel sector. Most hotels discount 10%, but shop around.

A Lifetime National Parks Pass is only $80--a must if you travel. Cell phone plans discount 10-15%, but shop around (Google Fi, Mint Mobile and other discount carriers).

Total Potential Savings up to $600 over the next 12 months

#31. Tame the Electricity Beast!

Identify all of your electricity hogs and develop strategies to deal with them. The average American home pays about $100-$130 per month for electricity. By making a few changes, you can save 20% on your bill over time.

Turn off the lights when you are not in the room. Replace your air filters every 3 months. Cook using a countertop appliance. Add a couple ceiling fans. Change burned out lights with energy-efficient alternatives. Reduce all major air leaks around the house. Buy a programmable smart thermostat to reduce energy consumption when you are not at home. Run the dishwasher and washer-dryer when you have full loads. Set your water heater to no more than 140 degrees Fahrenheit. Dress warmer in the winter.

Total Potential Savings up to $300 over the next 12 months

#32. Hire a Good Accountant for Your Taxes

Assuming you own a home and actively invest in the market, it pays to have an accountant file your taxes. The tax code is constantly changing, and it's easy to make a significant mistake. A recent survey of over 2,000 tax payers showed that self-filers, on average, received an $1,800 refund vs accountant-filings who received on average $2,600. Paying $300-350 for accounting services still leaves almost a 30% increase in your refund. You also have the peace of mind knowing the accountant will help defend you in an audit.

Total Potential Savings up to $500 over the next 12 months

#33. Choose Your Bank Wisely

The wrong bank can be costly to your bottom line! Choose a bank with a national network and a strong affiliated global network. Banks are notorious for their fees--ATM, overdraft, monthly account, transfer, and currency exchange. The average American pays about $330 in fees per year.

Find a bank that has the biggest reach, requires the lowest balance, and is sparing in charging extra fees. Capital One 360 and Schwab Bank rank very high on our checklist--both online banks. There are no monthly fees or minimum deposit requirements. They have strong networks and reimburse for global bank ATMs. Private ATMs will still have fees.

For savings, it may still be preferable to use Worthy Bonds at over 5% interest--hard to beat.

Total Potential Savings up to $320 over the next 12 months

#34. Actively Manage Subscriptions and Memberships

An audit of your subscriptions and memberships is a must for a disciplined budget. Take control with the Truebill app. Step One, review monthly credit card statements and identify all subscriptions and memberships. Step Two, cancel all subscriptions and memberships you don't need! Step Three, actively manage the remaining subscriptions.

Where possible, share streaming media subscriptions, e.g., Netflix. Use trial periods to your advantage. Rotate your streaming media subscriptions, e.g., Netflix, Showtime, and HBO (Max), when your favorite shows start new seasons.

Be careful of software subscriptions! Buy the software upfront instead, e.g., Adobe and Microsoft products.

Indoor fitness memberships can really add up over 5 years! Consider running or joining an outdoor community club or a Park Run.

Total Potential Savings up to $600 over the next 12 months

#35. If You Have Hair, Save Money on Maintenance

Hair styling and grooming don't have to cost a fortune. For most men, short hair is easy--buy a pair of decent hair clippers and enjoy years of saving!

For those requiring styling, network with friends to find a reasonably priced skilled hairstylist.

Adopt a style that is easy to manage, cut you own bangs, touch up your own roots, don't buy products at the salon, and skip the wash & style. After a few months, this will all come naturally.

Total Potential Savings up to $400 over the next 12 months

#36. Make Some Tough Decisions on Pets

We all love them, but pets can be costly and very limiting when it comes to travel. If you are considering a long-term Better Life on the Road, planning must come earlier rather than later. Traveling with pets will limit your options in accommodations, travel mode, and budget management.

This is very personal, of course. The simplest solution is to start a transition plan for a life without pets. Some long-term travelers get their pet fix by house sitting homes with pets.

The U.S. average annual cost to take care of a dog or cat is approximately $600 - $1,000. This includes food, pet insurance, medical expenses, and grooming.

Your transition plan should ideally aim to be pet-free by the time you hit the road.

Total Potential Savings will Depend on your Pet Status

It's Time to Get Busy! Let's Start Planning and Doing!

Major 1-Year Transition Goals that Need Immediate Planning

Disclaimer ... Again! Please be sure to consult your Financial Advisor and/or your Health Professional in all matters affecting finances and/or your health. Circumstances and realities vary significantly from person to person. The following strategies simply represent goals and strategies we have developed based on our own experiences.

Assuming you are seriously considering a full-time Life on the Road, there are a number of critical targets that need immediate planning.

This section identifies some of the major plans that need to be developed as soon as possible. These plans are drawn from our experience getting ready for our own adventure.

You have a year to get these transitions in place--it could get real busy!

#1. Finalize Your Real Estate Decisions

If you followed the 5-Years-To-Go Plan, you're probably in great shape already. For those new to the Road Hacker Plans, important real estate decisions need to be made as soon as possible!

If you want to keep a permanent base, then engineering your real estate strategy to fit your Life on the Road becomes the focus. If yes, then, location, size, and future cashflow become transition planning priorities. Check out our Real Estate Hacks Blog for more strategy.

Some of you may have to develop strategies to deal with a second home. Reality Check: You have 1 year to go! You could sell that second home, retire debt, and increase investments. Or, ... you could sell your primary home and relocate to your second home.

If you decide against a permanent home, you need to start researching and developing an alternative strategy--domestic and international. Consider a longterm-stay strategy (28+), using Airbnb. This will reduce your rental costs and retain rental flexibility as you travel.

A few of our real estate Pro Tip Strategies follow:

Downsize and Relocate

You could downsize your home and relocate to a cheaper area. This strategy doubles your gain, but is very disruptive.

Downsizing and relocating maximizes your mortgage savings--and that savings is available to pay off debt or for investments.

If you are in a position to relocate, consider buying a home that will become your permanent base once you start traveling. Choose a high-demand location like Myrtle Beach (SC) or Branson (MO). Your ideal target would be a highly desirable 1- or 2-bedroom condo with a professional management program.

Due diligence should show that rental revenues and expenses can support positive cashflow when you start traveling. Make sure that you have a solid accounting of all management fees & HOA dues.

Second Home Considerations

If you have a second home, you will need to decide how that figures into your travel plans. You could simply sell the second home, retire debt, and increase investments. Alternatively, you could plan to eventually sell your primary home and relocate to your second home.

#2. Finalize De-Clutter Strategy

It's time for the final de-cluttering of your home--and tying up those clutter loose ends! Transitioning to a smaller permanent homel takes discipline. Again, if you worked the 5-Years-To-Go Plan, you're in great shape! For the newbies, this is going to be one hectic year!

Our permanent base is a fully furnished 640 sq ft 1-bedroom condo. We had to figure out what to do with all that stuff ... clothes, furniture, appliances, collectibles, exercise equipment?

Our strategy was to liquidate everything we didn't need--and to keep those things that had high sentimental value. Initially, everything had to fit into a 10 x 5 ft storage unit. Ultimately, we did a final audit and kept only what would fit into our condo's owner's closet and our car.

'Easier said than done. It literally took years! Yard sale after yard sale, trips to the consignment store, dealing with sales brokers, negotiating with auction houses, and, of course, countless donation trips to Goodwill! Unfortunately, along the way, we collected even more stuff ... but the deadline eventually kept us honest.

A few of our declutter Pro Tip Strategies follow:

Sell Your Apparel

The amount of apparel we collected over the years is astounding--clothing, shoes, handbags, ties, belts, hats, and too many other categories to mention.

Luckily, the recycling/reuse movement has made retro cool again. Sites like Poshmark and ThreadUp are excellent vehicles for converting apparel into cash. For higher quality, pricier items, you might consider a consignment store. Yard sales are also key!

Sell Furniture, Appliances, ...

Shipping logistics are limiting factors in this category. The ideal strategy is to sell furniture, appliances, and equipment locally.

Local message boards like Facebook and Craig's List are your best bets. Hire a local online broker to take on your items if you aren't comfortable selling online. Consignment shops can also be great vehicles. Just remember, brokers and consignment shops take a commission.

Sell Your Valuable Collectibles

Valuable collectibles might include rare coins, old stamps, art, old bottles, collector-quality comics and books, and jewelry. This category requires much more due diligence. Reputable auction houses, consignment shops, and specialty online brokers should be consulted.

Be very careful to check references and reputation. Scams abound!

#3. Final Decisions on Remote Job Strategy

This section focuses on possible remote job strategies that will fit your eventual Life on the Road. For those completing the 5-Years-To-Go Plan, you should be well on you way with this transition. Time to get real serious!

There are a lot more options than you would expect. COVID has fundamentally transformed the workplace to be more remote-friendly.

Targets to Explore: Your existing job might have remote assignments; consulting presents increasing remote opportunities; selling goods & services online is all remote; teaching online is one of the most popular remote gigs; and, don't forget, there's always remote contract work online.

Set your goals for how much you would like to earn each year, and figure out what that will take in your chosen field. Who knows, you might even be able to get partial health benefits.

Research and planning will go a long way to better position you for your ideal remote strategy. Remember, if both partners work, you don't have to earn as much.

A few of our remote job Pro Tip Strategies follow:

Assess Skills for Remote Jobs

Determine which remote jobs you would like to target and assess your skill level. Ideally, you would have the skills necessary to be gainfully employed in your chosen field.

Your best case scenario would be to negotiate a part-time remote job with your current employer as part of an early retirement. Skilled and experienced employees are hard to replace.

You would also be viable for remote consulting or contract jobs in your industry.

Hobbies that can be monetized online are your next best opportunity. Clearly, you already have the skills for success here!

Need More Skills, Get Them!

You have the time to acquire new skills, update existing skills, and get certified for new remote jobs. Teaching presents a huge opportunity.

Teaching English-as-a-Second Language (ESL) requires a bachelors degree and TESOL/TEFL certification. Teaching college online usually requires a masters degree and some in-class teaching experience. Teaching at a local community college would satisfy this requirement.

Technology for Remote Work

Computers, WiFi routers, cell phones, and the most popular productivity software are all required tools of the trade. Make sure you have reliable tech. Apple products tend to be pricey, but they are reliable and have trade-in value when you upgrade. If you work in education, get the discounts!

#4. Develop Your Itineraries

The fun of developing an itinerary for your Life on the Road is unbeatable! This should be an itinerary that you both love--and that you can afford. A lot of factors go into developing the perfect itinerary.

The answers to the following questions will inform your itinerary: How long will you travel each year? Will you return to a permanent base at some point each year? Will you slow travel or visit as many countries as possible? What is your annual budget? Which countries inspire you? Will you house-sit? Will you keep a car at your permanent base?

During our planning phase, we chose to develop a 5-year itinerary so we could start ironing out some of the logistical issues that tend to pop up over longer periods of travel.

This model itinerary also forced us to answer many of the important questions required to start developing our model budget. The itinerary and budget go hand-in-hand. As one changes, so does the other, and vice versa.

Just know that your plan will constantly change as you get closer to final decision points. The key is to remain flexible and adaptable as circumstances change. COVID has certainly taught us that lesson.

A few of our itinerary Pro Tip Strategies follow:

Research Your Itinerary

Only you will know your preferences and interests. Use these to frame your research. We spent 5+ years looking into every possibility as we built our itinerary.

Your budget will be the biggest constraining factor. We wanted a mid-tier travel lifestyle, so, given our limited budget, we had to make sure we had a mix of cheaper and mid-tier countries. Check out our Travel Resources section for great research tools.

Determine Your Travel Lifestyle

Lots of questions here. If you have a permanent home base, how much time will you spend there each year? Make sure your base pays for itself while you travel.

Will you be back-packing and hostelling in shared accommodations? Or ... can you afford resort-style living? Are you open to Airbnb, Vrbo, and/or house sitting?

Will you cook at home or go out all the time? How important are excursions? Will you slow-travel (2 - 3 months per location). There are so many variables!

Develop Your Own 5-Year Plan

Take a shot at developing a 5-year itinerary. This will give you an idea of how your plan might work when finally in motion. The complexity of the inter-locking parts needs to be tested on paper.

Our first step was to build an annual travel model. This gave us a practical framework for our more detailed design. Our model included 10 - 12 weeks at our home base, 12 - 14 weeks of domestic travel, and 26 - 30 weeks out-of-country. Once we had the model, we were able to add the fun stuff--the places to visit!

#5. Finalize Digital Storage

This section focuses on developing a long range plan for keeping your information secure and accessible from anywhere in the world.

How difficult can it be to digitize your life? Very difficult! This is a tedious, time-consuming task that has a huge pay-off at the end. Part of getting ready for a Life on the Road is getting your digital life under control. This means you need to determine what "information" needs to be accessible.

You should ideally have access to all your key documents (paper and digital), photos, videos, and music. That's a tall order, because it means you will have to locate and convert all your content into digital format and upload all that content.

Organizing your uploaded digital files for easy access is also an important part of the overall process. This all takes time, but well worth it once finished.

It's truly freeing to know that we have access to all our important information whenever we need something. We also don't have to worry about our computers crashing!

A few of our digital storage Pro Tip Strategies follow:

Choose a Cloud Storage Option

Step one is to decide on a cloud storage vehicle that can satisfy your requirements--and not bankrupt. We considered the following providers: iCloud, MicroSoft OneDrive, Google Drive, & PCloud.

They're all very good options, but we chose PCloud based on excellent reviews, reliability, and outstanding value. We were able to get a life-time subscription to 4.1 Terabytes of storage for a one-time payment under $650. That's a lot of storage at a generous price!

Digitize Older Content

Converting old paper photos and documents into digital content was a time-consuming job. We bought a specialty photo box with LCD lighting customized for taking photos with our iPhone.

Cassette audios and VHS videos can be recorded on your iPhone and made available for digital upload. You can save time by having a vendor do the conversions, but this can get quite pricey.

Organize & Upload Digital Files

The final step is to locate and organize all of your existing digital content and to start uploading your life to the cloud!

Locating all your digital files sounds simple enough, but we had quite a time doing just that. Our digital footprint was scattered over several devices and cloud storage areas.

Once located, we had to organize our files for easy access once uploaded. Now that it's all done, it's all gravy! And we have instant access to every photo that used to be stored away in boxes, rarely to be looked at again!

#6. Plan for Healthcare

Before making any decisions related to Healthcare, please consult your Health Professional first!

This section focuses on possible long range strategies to address your healthcare needs on the road. The two biggest obstacles for most aspiring full-time travelers are finances and healthcare insurance.

Healthcare is particularly difficult for Americans dreaming of a Life on the Road. The costs are prohibitive and network coverage can be limiting. Out-of-country travel just adds to the apprehension.

So, what does one do in the gap between leaving your full-time job and the day your retirement insurance (age 60) and/or Medicare (age 65) kicks in? There are no easy solutions here, but you do need a plan.

We've done a lot of research on this matter. All we can do here is describe our experience. Our gap strategy is not ideal--and not for most people. It involves some creativity, cobbling together a few buckets of coverage that we can afford.

We self-pay for all doctor's visits, labs, vaccinations, and prescriptions. Be sure to let people know you don't have health insurance--this helps contain prices. We also have World Nomads travel insurance that covers us for most medical emergencies anywhere in the world 90 miles or more away from home.

For more serious health issues, we plan to evacuate to Malaysia or South Africa--a medical tourism strategy. Both countries have outstanding western-trained medical staff and unusually low prices.

It's not the most secure plan, but it is the best possible plan we can afford. If this makes you nervous, you could opt for Integra Global or IMGlobal for traditional health coverage. Also consider health plans in each country you visit. Many in-country plans are very affordable.

Understand Your Healthcare Gap

As we prepared for our Life on the Road, healthcare insurance became a big concern. We were in our mid-50s and deep in the uncomfortable gap before our State Pension health insurance kicked in at 60, and a long way from Medicare at 65.

Unfortunately, we still earned too much to qualify for cheaper health insurance under the Affordable Care Act. Our only real option was to take the risk and cobble together some form of coverage using self-pay, travel insurance, local insurance, and medical tourism.

If you are lucky enough to have State or Medicare insurance, you're fortunate. Just be sure to consult an expert before declining coverage--to avoid long term coverage issues.

Our Gap Plan for Healthcare

Our healthcare approach:

Other gap possibilities: Integra Global and IMGlobal are a little more expensive, but provide traditional health coverage worldwide.

Be Healthy: Exercise, Eat Right

The best insurance policy of all is the common sense of exercising and eating right. Neither of us smoke or drink alcohol on a regular basis. Rainman runs ultra-marathons and Tricia is an avid swimmer and exercise walker.

We eat healthy, favoring a mostly vegetarian Mediterranean diet. Our biggest unhealthy weakness is probably too much cheese in our recipes and, of course, a lot of ice cream! Healthy snacks are a must.

#7. Transition Strategies for Pets & Cars

If you haven't started yet, it's time to finalize your transition plans for your pets and cars.

Five years ago, we had a cat and 2 cars. We have now transitioned to a single car and no pets. Our precious cat passed at age 20. We chose not to take on another pet at that point. It was a difficult decision, but we knew our new Life on the Road would not be pet-friendly.

There are other options to consider, though. You might keep your pet and have them travel with you. This strategy comes with a number of hurdles. You will need to become an expert on the international travel rules for pets.

A good fall-back might be to leave your pet with family, friends, or a trusted neighbor.

A couple of months before we set off on our adventure, we sold our second car, keeping our more reliable and newer-model Toyota. Your budget and your lifestyle will most likely determine your car decisions.

Some of you will choose not to keep a car at all. Any which way, it is important to have a timeline for this important transition.

Everyone will have their own realities to manage.

A few of our pet & car Pro Tip Strategies follow:

Decisions to be Made

Tough decisions need to be made here. Will you have pets? If so, will pets travel with you or stay with friends or family?

How many vehicles, if any, will you keep once you begin traveling? Where will you park these vehicles?

These decisions, and the strategies you develop based on those decisions, will impact your travel planning options.

Possible Pet Strategies

Let's assume you decide to travel with your pet. You will need to get a pet health passport or certificate showing all required vaccinations. Most countries also require that your pet get micro-chipped.

The U.S. is considered a rabies-controlled country. Beware of the restrictions in rabies-free countries. You will also need to know the pet quarantine requirements. Keep in mind, certain dog breeds are not allowed in some countries.

The least complicated strategy is the no-pet option. For some, this is not tenable--and that is understandable. Think about making arrangements for your pet to stay with family, friends, or neighbors. All of this figures into your decision-making and planning.

Possible Car Strategies

There is little reason to keep more than one car once you start your Life on the Road. Some might decide that a car is not necessary at all.

The expense of each vehicle adds up quickly--registration, maintenance, inspections, storage, insurance. We kept one vehicle for all domestic U.S. travel and park it at our Myrtle Beach condo when traveling overseas. This strategy saves us a lot compared to Uber, LYFT, and rental cars.

Your job is to develop a timeline for selling your extra cars. Consider trading them in for the ideal travel car--think comfort.

#8. Strategies for Research

One of your most time-consuming tasks will be to research all of your options for a Life on the Road. We have already highlighted the importance of getting a head-start on your potential itinerary and developing the perfect budget.

This section identifies some other key areas that may need your special focus sooner than later:

These seem like relatively easy decisions, but you will be glad you put in the time and planned ahead. Full-time travel has its own nuances and requirements.

Legions of travelers have made the mistakes you are going to want to avoid. Not having a cell phone strategy or a WiFi router can make a huge difference in your ability to have reliable, robust, secure access to all the online content you use.

Researching your best options before you need them will significantly enhance your travel experience. We have pulled a lot of the best thinking together to make it easier. Check out our Travel Hacking Blogs for detailed discussion of all the best work-arounds and strategies.

A few of our research Pro Tip Strategies follow:

Key Research Questions

This section highlights some of the major questions that need to be researched as you get ready for a Life on the Road.

Banking, Travel Insurance, Cell

Banking: Check out Capital One 360 and Charles Schwab Investor Checking accounts. Access, minimums, and fees are key here.

Travel Insurance: Take a look at World Nomads, Safety Wing, or True Traveller (UK/Europe citizens). Your legal residence is important here.

Cell Phone: Choose a flexible, affordable domestic plan like Google Fi or Mint Mobile (U.S.). Have an unlocked phone and use WiFi (WhatsApp) and local SIM cards internationally.

Storage, Mail, Technology

Long Term Storage (if needed): Once you you have downsized, you may have excess items that require storage. Make sure you take this into account when building your budget. Limit yourself to a 10 x 10 or 10 x 5 sq ft unit. Lock in your rate during off-season and take advantage of discounts for upfront payments.

Virtual Mail: Take a look at Traveling Mailbox. The Basic Plan is fine for most travelers at $15 per month. They scan, store, and shred your mail. They even deposit checks. Manage your mail from anywhere.

Technology: At a minimum, you need a reliable light-weight laptop or robust tablet and a dependable cell phone. A WiFi router (one of the GL products) and a VPN subscription (ExpressVPN) are recommended for device and account security. Don't forget battery back-up!

Are You Ready? Let's Design Your First Budget for the Road!

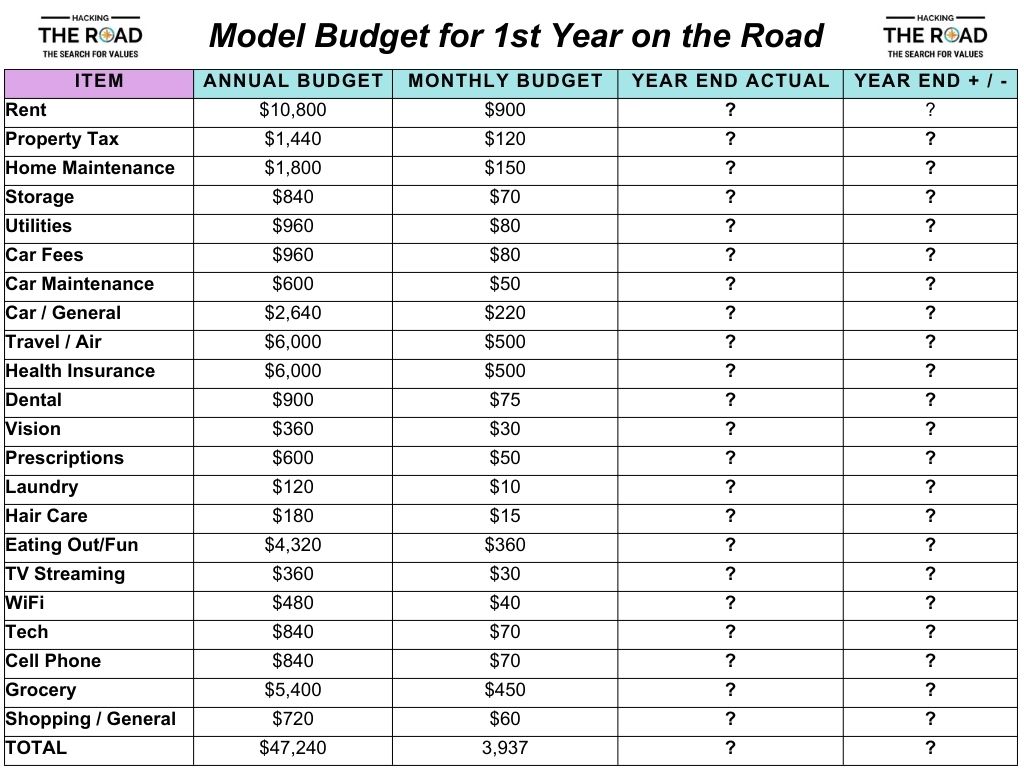

Your Budget for the First Year on the Road

There is no doubt, this is a lot to take in--especially if you weren't with us for the original 5-Years-To-Go Plan.

But, don't worry! We've got your back with our structured 1-Year-To-Go Plan. Here's what we've covered so far:

Do you feel better? Well, then it's time to design the first budget for your eventual Life on the Road! You may think this premature, but you need to start planning for the lifestyle your budget can afford.

Compare this first year budget to your current pre-launch budget. Are you spending more or less? This comparison will give you insight into the kind of adjustments you need to make over the next year.

Keep in mind, this is simply the model budget we developed for our own purposes--based on our own circumstances. Your realities will be very different. Feel free to customize your own budget to reflect these realities.

The model budget is just a starting point. Just know, your budget is not cast in stone--it will need to be dynamic as you learn to live on the road.

Here are some of the major assumptions underlying the model budget that follows--see table below:

General Assumptions:

Permanent Home & Rental Accommodation Budget Detail (see table below):

Transportation Budget Detail (see table below):

Health & Beauty Budget Detail (see table below):

Entertainment & Technology Budget Detail (see table below):

Shopping Budget Detail (see table below):

Annual/Monthly Budget Totals (see table below):

Here It Is, Your Budget for the First Year on the Road!

Get Ready for Adventure! Let's Start Building an Itinerary!

The Building Blocks of Our Model 5-Year Itinerary

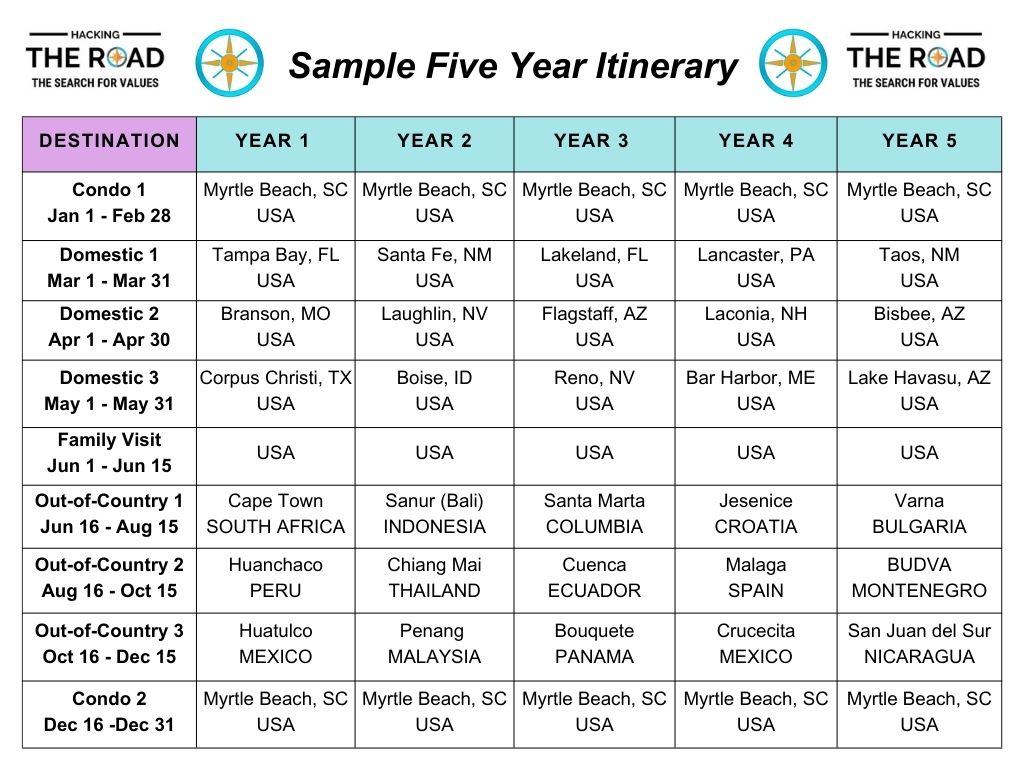

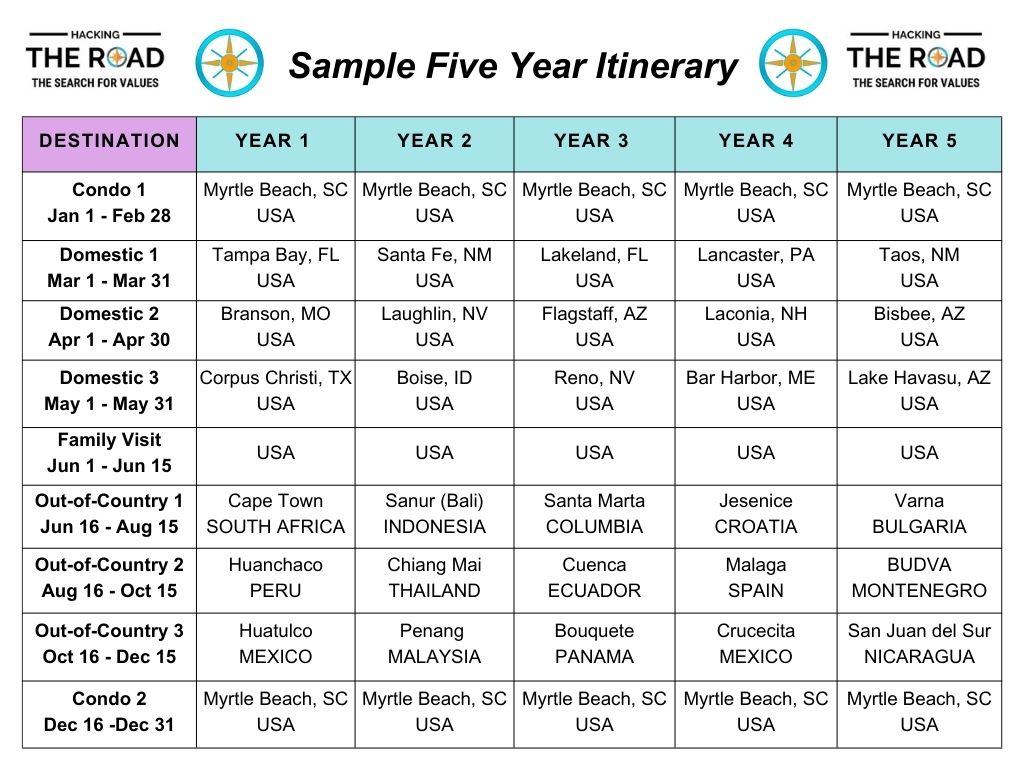

As promised, this is where we share our Model 5-Year Itinerary.

Use this model to start crafting your own travel flow. This will give you an idea of how your plan might work when finally in motion. The complexity of the inter-locking parts needs to be tested on paper before you hit the road.

Our first step was to build a prototype annual travel framework. The framework was important for itinerary planning and served as the basis for creating a realistic long term budget.

The timing for the different itinerary segments was one of the most important considerations.

The following outline shows a general timeline for each of our major travel categories across one year:

This gave us a practical framework for our more detailed travel design.Your budget and travel preferences will impact the design of your framework.

Here are some of the other factors that informed our design:

Let's Create a Sample 5-Year Itinerary!

We have developed a sample 5-year itinerary framework based on the above design guidelines.

Keep in mind, this is just a model--a guide for planning purposes only.

The framework is made up of 4 major categories of travel--Condo (visits to our condo in Myrtle Beach); Domestic (3 new US locations for at least 1 month each); Family Visit (our annual visit with family); and Out-of-Country (3 new foreign locations each year).

The itinerary chart included below is organized chronologically (January - December)--and is divided into the following sub-categories:

The chart below includes sample locations that might be grouped together for each or the 5 years.

Note: "OOC" is used to abbreviate "Out-of-Country" below.

Now the Hard Work is Underway, Let's Peek into Your Future!

Testing the Budget Model for Your First 5 Years on the Road

You've reviewed the model plan and you're fine-tuning your strategy for moving forward. Never lose sight of your ultimate goal and why you are doing all of this. Your eventual Better Life on the Road is worth every sacrifice you make. Just keep thinking that every dollar earned, saved, and invested brings you closer to your Better Life.

The Budget 101 Hacks above show how powerful your decisions can be in making this happen. You have control over these decisions. You can shorten or stretch your timelines--your choice.

Your motivation for all the hard work is the reward of finally being on the road. Keep reminding yourself. Be sure to regularly check your progress as you reach key targets along the way. The lure of this ultimate reward kept us driven every step of the way!

Every time we had a setback, we just reminded ourselves of the dream. Oh, the places we would visit, the food we would eat, the people we would meet, the music we would hear, and the adventures we would experience. That always snapped us back into focus ... and we would redouble our efforts.

Be resilient in every moment and you will succeed.

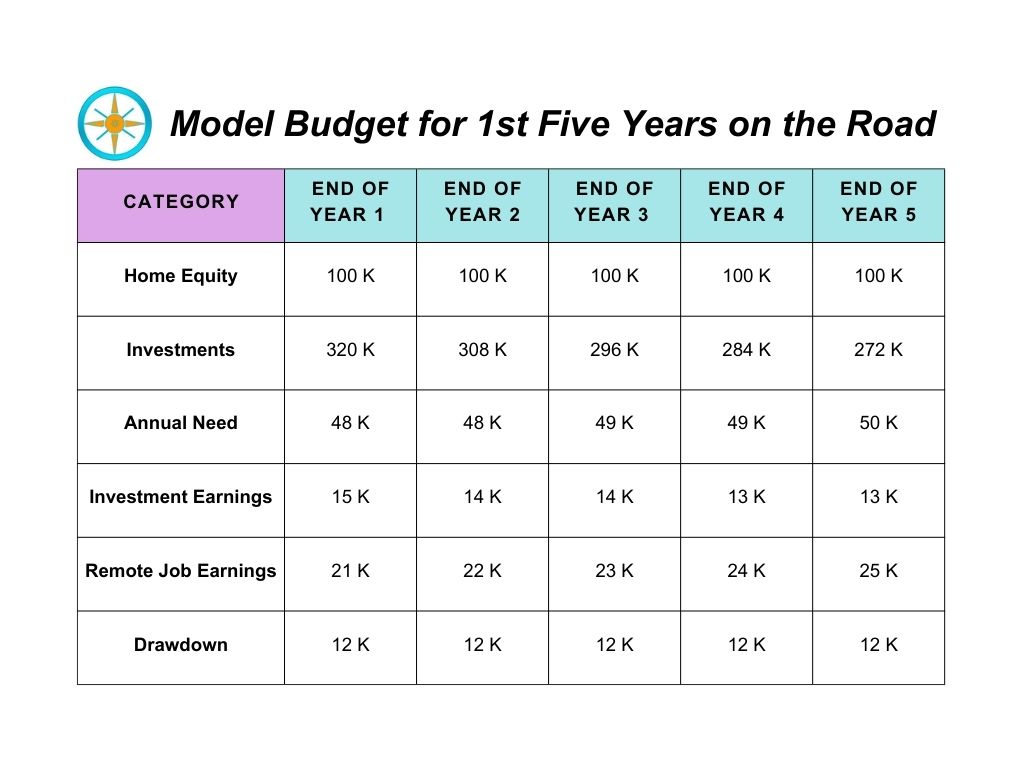

The table in the next section will give you a peek into how your funding might work during your first 5 years on the road.

First, let's review the assumed goals of our 1-Year-To-Go model:

Next, let's go over the assumptions of your budget for the first 5 years on the road (see the chart in the next section):

Feel free to adjust these numbers to fit your own customized model.

Here it is, Your Model Budget for the First 5 Years on the Road!