QUICK VIEW:

So you've taken the plunge and you're living your Better Life on the Road! Planning will be crucial to sustain a life of longterm travel. This article offers practical suggestions on Travel Strategies, Sustainable Budgeting, Sample Itineraries, and Valuable Road Hacks.

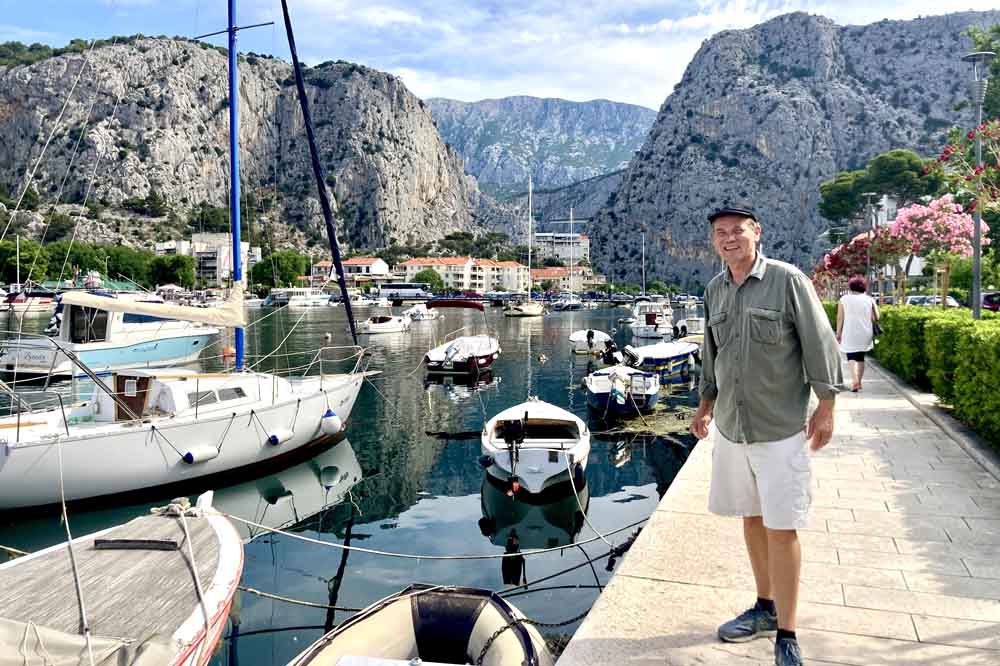

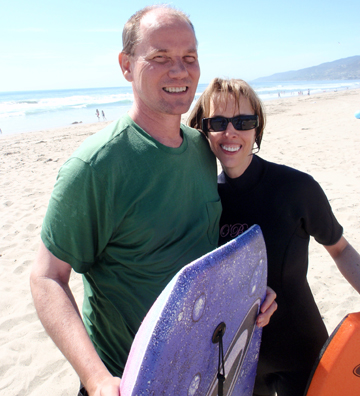

At Hacking the Road, we are dedicated to finding ways to help people live a Better Life ... on the Road! We are full-time travelers and experience seekers, and we want to share our journey with you. We believe that travel opens hearts and minds, and makes the world a better place. Join us as we explore each new destination.

Longterm Travel Plan!

Please consult your Financial Advisor for all financial decisions hypothesized in this blog. We are NOT qualified Financial Advisors or Health Professionals. The plans developed simply represent an approximation of the strategies we developed for our own full-time travel needs. Hacking the Road does not warrant or guarantee success.

This blog assumes that you are about to start--or already living--your Better Life on the Road. Our Longterm Travel Plan focuses on improving your day-to-day travel experiences and offers suggestions for enhancing your financial sustainability for a life of longterm travel.

As you know, it takes quite a bit of planning and preparation to successfully sustain your Better Life on the Road. This can be quite daunting, but, no worries, this blog will walk you through our Longterm Travel Plan Hacks and Travel Strategies step by step.

Let's Get You Oriented!

So, you've taken the plunge and you're working your plan. What a great accomplishment!

You've done the hard work of squaring away your finances and making the necessary adjustments to live full-time on the road (traveling at least 9 - 10 months each year).

Our Longterm Travel Plan will help you build a budget to stay on the Road. We will show you a sample itinerary and discuss some of the budget realities that come with building an itinerary.

The plan will also share our valuable Budget 101 Hacks and how these hacks can save you thousands of dollars--to keep you on the Road.

This model plan assumes that you are about to live (or already living) the dream of a Better Life on the Road--and that you are adequately funded.

By "adequately funded," we mean that you have access to the minimum funding assumed for the Longterm Travel Plan--see detailed budget assumptions below.

We fully recognize that many people travel the world successfully with less funding. Others need a lot more financial security before they commit to full-time travel.

The Longterm Travel Plan splits the difference and aims to fund a mid-tier lifestyle on the road. Whether you require fewer funds or more funds, you can adjust the Longterm Travel Plan to align with your own lifestyle preferences.

Should you decide on a lower-tier lifestyle, your Plan might include shared accommodation strategies and other lifestyle adjustments to the model budget.

A higher-tier lifestyle might add several cruises each year, stay at more upscale accommodations, and increase the number of excursions at each destination. It all depends on the lifestyle you can afford. The model is there for you to adjust.

In case you are new to Hacking the Road, you may want to review our recommendations in the earlier 5-Years-To-Go and 1-Year-To-Go Plans.

Hopefully, you'll find a few cost-saving strategies for your own custom plan. We will do our best to bring you up to speed. Our goal is to better position your finances for longterm travel--and to keep you on the Road.

Assumptions of Our Model Travel Budget

For those not familiar with our planning strategies, here's a quick orientation on our model planning process:

The Model Assumptions will most likely not fit your situation perfectly. Your job is to use this model to develop your own customized plan that will accommodate your own realities and goals.

The model will provide an organized way to analyze your situation and to build your own action plans and targets. This is simply a framework for your reference and can be a powerful tool in your arsenal.

Let's review the basic Model Assumptions (Longterm Travel Model):

Don't worry if your finances don't match the above targets. This is just a model. You're in the ballpark as long as you have combined assets of approximately $420,000 and very little debt.

The goal is to have sufficient funds until you decide to add social security to your funding mix.

In Case You're More Visual

Longterm Plan Starting Assumptions

Starting Investments/401 K

Credit & Car Debt

Starting Home Equity

Student Loan Debt

Starting Savings

Net Asset Position

Build a 5-Year Budget for the Road

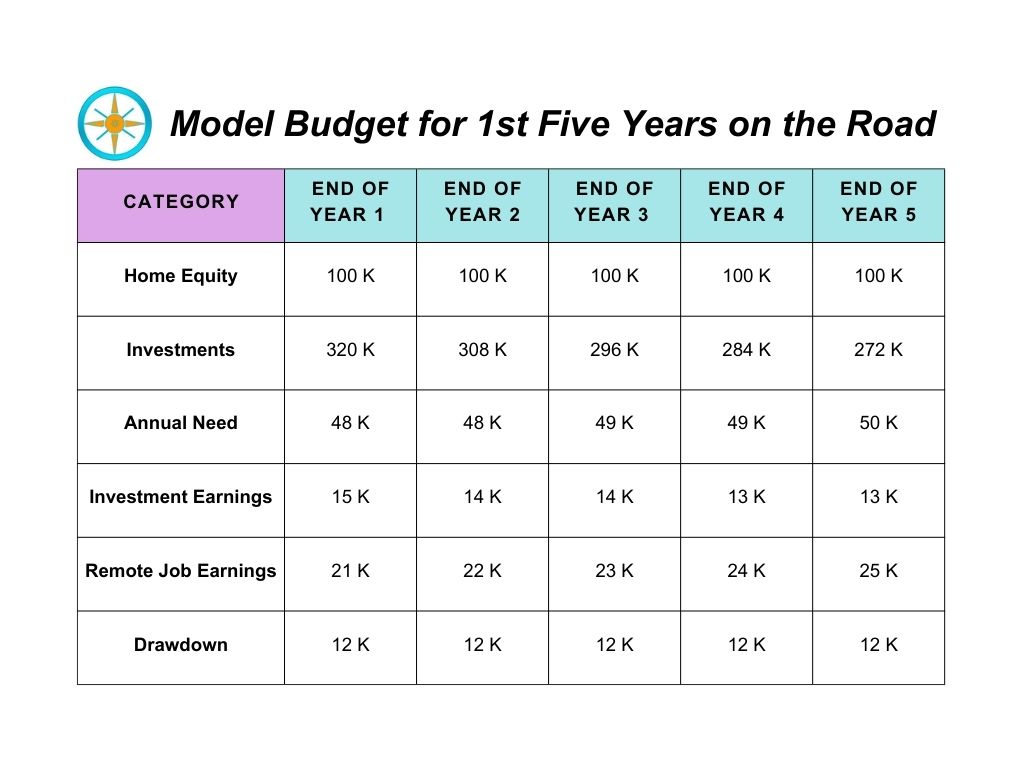

Based on these assumptions, we built a model budget that would be capable of sustaining you for the first 5 years on the road.

Now, let's test to see how this budget model holds up over the first 5 years on the road--see table below.

Here are the assumptions for the table below:

Feel free to adjust these numbers to fit your own customized model

Many of you may have already exceeded these goals. You're in great shape!

Here's the table for the 5-year Model Budget:

Let's Take a Look at the Budget Details!

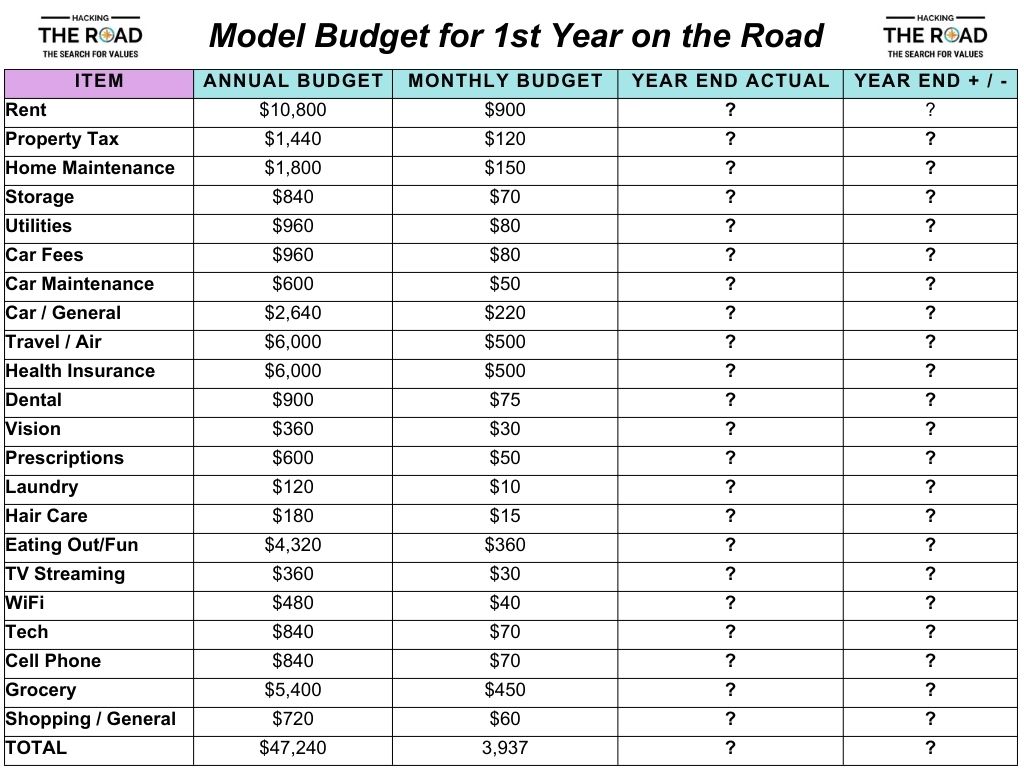

A Sample Budget for Your First Year on the Road

There is no doubt, this is a lot to take in--especially if you weren't with us for the original 5-Years-To-Go and 1 Year-To-Go Plans. In this section, we take a look at the detail that goes into building the budget for your first year on the road.

Many of you are already on the road and have a budget of your own. In that case, this may be an opportunity to review your budget for possible changes and savings. Keep in mind, this budget aligns with the overall model as described earlier.

Compare this model first year budget to your own current budget. Are you spending more or less? This comparison will give you insight into the kind of adjustments you need to make over the next year.

If your real estate equity and/or investments exceed the base model minimums, you can increase your annual budget in proportion to that overage.

For example, if these assets are 10% above the minimums, you can possibly increase your budget by 10%. This is very simplistic, but you probably get the gist of possible adjustments.

Keep in mind, this is the model budget we developed for our own purposes--based on our own circumstances. Your realities will be very different. Feel free to customize your own budget to reflect these realities.

The model budget is just a starting point. Just know, your budget is not cast in stone--it will need to be dynamic as you learn to live on the road.

Here are some of the major assumptions underlying the first year budget that follows--see table below:

General Assumptions:

Permanent Home & Rental Accommodation Budget Detail (see table below):

Transportation Budget Detail (see table below):

Health & Beauty Budget Detail (see table below):

Entertainment & Technology Budget Detail (see table below):

Shopping Budget Detail (see table below):

Annual/Monthly Budget Totals (see table below):

The Visual of Your 1st Year Travel Budget

Longterm Strategies that Can Make this Work

Applying Our Budget 101 Hacks

Please be sure to consult your Financial Advisor and/or your Health Professional in all matters affecting finances and/or your health. Circumstances and realities vary significantly from person to person. The following strategies simply represent goals and strategies we have developed based on our own experiences.

Before we review the Model Itinerary, let's go over some of our best Budget 101 Hacks--shared in our 5-Years-To-Go and 1-Year-To-Go Plans.

Hackers on the Road has assembled a list of Budget 101 Hacks that can be easily applied as you develop your own Longterm Travel Plan.

Going through all of these hacks diligently will provide an efficient financial health check for your personal financial situation.

The following section outlines these Hacks and provides resources for possible action plans. Not all the Hacks will necessarily apply in your situation. Your job is to find ways to integrate the best hacks into your plan.

Many of these hacks are more applicable to your domestic context, but some also apply to your new nomadic lifestyle. Your particular circumstances will determine which hacks have the most potential.

A careful review of these hacks is well worth the time. Hopefully, adoption of some of these strategies will allow you to leverage your budget for a better quality of life on the Road.

Each Hack shows the potential savings over the next 12 months. Keep in mind, many of these savings will likely be ongoing while you travel.

#1. Pay Down Non-Mortgage Interest

Eliminate all high-interest debt--highest first. Credit cards, installment debt, and retail credit are all examples of high interest obligations. Set your target date for your full-time travel and plan to pay off all high interest debt by that date. The average American pays $280,000 in interest over a lifetime. Average non-mortgage debt in the U.S is about $27,000. Average credit card rates are 20%+, student loans average 4%.

Total Savings up to $2,000 over the next 12 months

#2. Down-Size Home Size

Downsize your home, reduce your mortgage payment. The median price of a new U.S. home is approximately $284,000, with a monthly mortgage payment of $1,750 (including PMI). The average home size is about 2,500 sq ft. Interest paid over 30 years would be about $200,000 (4% rate). Reducing home size to 1800 sq ft will reduce the monthly payment by approximately $450 per month.

Total Potential Earnings up to $5,400 over the next 12 months

#3. Cut the TV-Viewing Cord

Change how you view television and save $$. Cord cutting gets easier and easier. Alternatives to most programming are available through an increasing number of streaming vendors. The average American family pays about $75 for cable or satellite TV. An impressive package of streaming subscriptions including Netflix, Amazon Prime, Paramount+ (CBS), Disney+, and ESPN+ would cost approximately $45 per month.

Total Savings up to $540 over the next 12 months

#4. Don't Overpay for Internet

Save on home internet costs. We all need access to a reliable internet connection, but it doesn't need to cost a fortune. The average American pays $60 -$80 per month--half the population pays more.

The key to saving here is to actively manage your account. Shop around for promotions and check your bill for extra charges. Most of us are overpaying for speeds we don't need. 100Mbps is just fine for most. Save at least $10 per month by owning your own router-modem.

Total Potential Savings up to $240 over the next 12 months

#5. Get Cell Phone Bill Under Control

Cell phone bills are out of control, but they can be controlled. The average American family pays about $115 per month for cell phone plans.

The following strategies can be used to reduce this liability: Try to keep your smart phone for at least 3 years; shop around for promotions; get rid of extra charges on your account; get senior and/or military discounts; check out Mint Mobile, Google Fi, Reach Mobile, and/or Pure Talk for savings of at least $50 per month.

Total Potential Savings up to $600 over the next 12 months

#6. Don't Trade in That Car

Buy a reliable second-hand car, maintain it, and keep it! Most people make the mistake of trading in their vehicle too soon. The average American keeps their car for 6 years, owes $4,600 at trade in, and always has a car payment. That liability is a huge contributor to consumer debt.

The average monthly car payment is about $450. Keeping your car for 15 years can really add up to significant savings--and investing those savings will compound the benefit. Buy a solid Toyota, Honda, Nissan, or Subaru.

Total Savings up to $5,400 over the next 12 months

#7. Technology Can Cost Less

Buy quality technology, buy refurbished, and keep your gadgets longer. Check Consumer Reports and buy reliable technology. Buying refurbished can save about 30% compared to new.

Take a look at Back Market, Amazon, and Walmart for deals. Keeping your smart phones and computers for an extra year can further reduce your average annual tech cost by another 30%.Most couples have at least 2 cell phones, 2 laptops, and 1 tablet. That's big savings!

Total Potential Savings up to $300 over the next 12 months

#8. Savings Should Work 24/7

If your savings aren't working, you're not saving. The average American has approximately $5,500 in cash, checking, and money market funds. Very few realize much of a return on this money.

We have used Worthy Bonds to park these funds at a very generous 5% (recently increased to 5.5%) annualized return. Best of all, the Worthy App is easy to use and provides daily interest updates. Another benefit is that your funds can be available more or less within a week when needed.

Total Potential Savings up to $300 over the next 12 months

#9. Long Term Passive Investment Strategies Work

Buy a passive S&P Index Fund (SPY) to take advantage of impressive longterm growth averages! The S&P has averaged 7%+ appreciation annually since the 1920s. The key to this strategy is a time horizon of at least 10 years. Gains and losses tend to come in big spurts and collapses. Over time, the upward trend line has held.

The S&P is up an average of over 8% per year since December 1999. Over 20 years, the average equity investor underperforms the S&P by about 4.5%. For our Net Gain calculation, let's assume the average 50-year old has $135,000 invested.

Total Net Gain up to $6,000 over the next 12 months

#10. Long Term Active Dividend Growth Investment

For the more adventurous longterm investor, a dividend growth strategy may be more attractive. What if you could get both portfolio appreciation and a steady stream of annual income?

The DivGro 2.0 website shows how they have actively managed such a portfolio over the last 9+ years. Their active strategy has yielded an annualized return of over 26% through 2021! All income is reinvested. DivGro 2.0 has outperformed annualized S&P returns by a whopping 17% over the same period.

The 1-year net gain below is compared to the performance of the average investor with an average $135,000 portfolio at age 50. 'Subscription is required.

Total Net Gain $20,000+ over the next 12 months

#11. Shop Home and Car Insurance

Conduct an audit on your home and car insurance, actively shop for savings, bundle to save more. Stay on top of your home and auto insurance costs. Annually shop around for the best rates. Bundling both home and auto insurance with the same insurer tends to yield the best result. The average American saves 17% with this strategy. Pay upfront for the year to save another 5%.

Total Potential Savings up to $700 over the next 12 months

#12. Skip the Convenience of Starbucks and Dunkin' Donuts

Kick the coffee & snack quick fix at Starbucks and Dunkin' Donuts, it's costing you a fortune! The average American conservatively spends about $4 each week day at Starbucks and/or Dunkin' Donuts. Enough said, you know you do! With a little planning, you can easily satisfy your habit by brewing at home and purchasing K-Cups for the office. Use free holiday and birthday gift cards when you really have to go.

Total Potential Savings up to $1,000 over the next 12 months

#13. Avoid the Soda Habit at Restaurants

Drink your Soda at Home, not at the Restaurant. A nice cold glass of water with a refreshing slice of lemon more than replaces the unhealthy sugary soda drinks offered by most restaurants. The average American couple eats out at least once each week. The average restaurant soda costs about $2.50 per order. That can be as much as 16% of the total order.

Total Potential Savings up to $300 over the next 12 months

#14. Outsmart the Alcohol Trap at Restaurants

Stay away from ordering alcohol at restaurants and reward yourself later. Alcohol sales represent a huge mark-up opportunity for restaurants. The average restaurant alcohol order can easily be 25-30% of the total bill. The average couple could conservatively spend $15 per outing once a week.

Total Potential Savings up to $800 over the next 12 months

#15. Fewer Restaurant Visits, More Home Cooking

Learn to make pizza or cook that steak at home, it's fun!The average home-cooked meal cost approximately $4 to prepare. The average restaurant meal conservatively costs about $14 without tax and tip. Besides, home-cooked meals are substantially healthier, with less salt, fat, and sugars--a win-win. The average couple has a restaurant sit-down meal at least once per week. Eating out once each month adds up to big savings! Don't forget Groupon and Restaurant.com!

Total Potential Savings up to $1,400 over the next 12 months

#16. Don't Overpay for Storage

Audit your storage needs every year. We've all been there. Maybe we'll need this, maybe we'll need that. Better keep it! Next thing, we're paying for storage. Key: Never pay for storage bigger than you need. You can buy new stuff with the money you save. Step one, make some tough decisions--trash, cash, donate, keep. Sell things you don't need, trash the junk, donate the things you don't sell, keep your essentials. Downsizing from a 10 ft x10 ft to a 10 ft x 5ft locker easily saves $40 a month. Pay upfront for 12 months and save another 8%.

Total Potential Savings up to $480 over the next 12 months

#17. Sell That Extra Car

If you don't regularly use that extra car, you don't need it! An extra car is a money pit. You are obligated to maintain it, pay for insurance, and pay for registration. Why not turn it into cash. Besides, it takes up a lot of room. The average American family own 3+ cars. Consider car-pooling, the occasional Uber or Lyft, or cycling to cut down on your car needs.

Total Potential Savings up to $1,600 over the next 12 months

#18. Get That Dreaded Side Hustle Going

Side hustles abound, pick one that suits your schedule and talents. There are so many convenient side hustles today. COVID has single-handedly main-streamed remote working as a viable option for millions around the world. The options are boundless. ETSY is there for the artists and artisans, Ebay and Amazon provide robust marketplaces for all kinds of merchandising, and then there are all the free-lance sites like Upwork and Fiverr for remote project-based work. You could try your hand at Airbnb or Vrbo, or get certified to teach English as a Second Language for online tutoring.

Total Potential Earnings up to $5,000 over the next 12 months

There's More? Make it Stop!

#19. Become a Grocery Shopping Guru

Become an expert grocery shopper by studying flyers, clipping coupons, and shopping multiple stores. There are big savings here if you are willing to put in the upfront time. Once a week, mail boxes are flooded with grocery flyers and coupons. The Sunday paper is a good source for major coupons. Online coupons can be found at SmartSource.com. Develop a list of your regular staples. Plot your weekly shop with your flyers and coupons in mind. We maximize our savings by shopping at Aldi (similar to Lidl), Walmart, and Sam's Club (similar to Costco). The USDA's Moderate Cost Plan estimates monthly grocery costs at $625 per couple. A skilled shopper can save almost 30% off that total.

Total Potential Savings up to $2,000 over the next 12 months

#20. Reject the Landline Offer

Reject cable or satellite packages offering to bundle their services with a landline. If you have a landline, ask to have it removed from your bill. Landlines are still in favor with those concerned about cell phone reliability during a crisis (weather especially). You will need to decide whether this $25-$35 per month expense is worth the extra peace of mind.

Total Potential Earnings up to $360 over the next 12 months

#21. Don't Spend Tax Refunds

Have the IRS direct deposit your refund and save the full amount. The average American receives a tax refund of approximately $2,800 each year. Unfortunately, this check is mostly seen as a windfall and quickly spent. $2,800 invested (5%) each year over a 40-year career results in a sizable nest egg of about $350,000.

Total Potential Earnings up to $3,000 over the next 12 months

#22. Consider a Warren Buffet Mindset

Warren Buffet's success is no accident. Warren buys undervalued assets, holds them for the longterm, and liquidates when his goals are met. There is no reason this strategy can't be implemented in your portfolio. The longterm extremes of market cycles in the Oil & Energy Industry represent significant opportunities for investors with patience and long horizons.

The play here is to buy 5%+ dividend paying midstream Oil & Energy stocks when the per-barrel cost of oil falls below $40, and then sell when oil hits $70.

This opportunity has surfaced 3 times since 2001: Oct 2001-Sept 2004; Jan 2016-January 2018; and March 2020-Jun 2021.

Assume an investment of $50,000 with 3 opportunities over the last 20 years. While you wait for the big pay-off, the dividends will keep you flush--take a look at KMI, EPD, TRP, ET, and ENB. Before 2000, the cycles were longer, but the emergence of China and India have changed the market dynamic.

Total Potential Average Earnings Depends on Opportunity being Available

#23. Consider Thrift Outlets for Great Clothing and Apparel Savings

Goodwill, ThredUp, Poshmark, and other resale merchants should be a part of your wardrobe. Sustainable resale is cool now! According to ThredUp, 33 million people bought thrift resale for the first time in 2020--and 76% expect to continue this new habit. On average, Thrifters are buying 7 thrift pieces that they would normally purchase new. A significant number of people spend more than a $1,000 per year in this category. Thrifts offer discounts of over 50% across the board.

Total Potential Savings up to $500 over the next 12 months

#24. Stretch Your Entertainment Dollar to the Max

Entertainment is critical to our sanity, but it doesn't need to cost a lot. The average American adult spends about $3,000 on entertainment annually. Try to cut that in half! If you must go to the movies, attend a matinee, go Monday through Thursday, or find a low budget theater. Better yet, stream recent movies at home and make an evening of it for the family! Start following the local high school sports teams. If you must go out for drinks, choose Happy Hour and limit yourself to once per month. Organize a monthly potluck dinner that rotates among your friends. Find free concerts. If you love the casino slots, find machines that have lower denominations and be disciplined with a set budget. It all adds up!

Total Potential Savings up to $1,500 over the next 12 months

#25. Change the Way You Vacation

Be strategic in the way you vacation. The average American couple spends about $3,000 on vacations each year. Most of us live within a day's drive of amazing destinations. Reduce the number of vacations where airfare and a rental car are required. Some of that savings can be used to do more and stay at nicer places.

Check out Airbnb, Vrbo, Booking.com, Expedia, and Hotel Tonight for the best deals. Book lodging that has a kitchen or free breakfast. Sometimes booking 15-20 miles away is much cheaper. Consider home swapping via Home Exchange or Love Home Swap to save on accommodation and transport. Use smart search engines for cheaper flights. Agoda and Skiplagged are consistently good. Try Kayak and Google Flights for multi-city flights. Always check Southwest, Ryan Air, Volaris, and Easy Jet. They are not included in most searches! Make sure you earn and use your frequent flyer miles.

Total Potential Savings up to $1,500 over the next 12 months

#26. Take Control of Your Healthcare Costs

Beyond major medical necessities, most healthcare expenditures are discretionary. In other words they are controllable. Many doctor's visits can be completed via Telehealth at $30 - $40 per visit--cheaper than the co-pay with your insurance.

Make sure your medical professional writes a prescription allowing the generic version of the medication. The average brand drug costs about $96 vs $28 a month for the generic version. A 3-month supply can also reduce the monthly average cost. Shop for the best prescription prices and check out GoodRx.

Always stay in-network for all medical procedures to avoid unexpected bills.

Take a good multi-vitamin and exercise! Consider Urgent Care instead of the Emergency Room for minor concerns--reduced out-of-pocket, and less time.

Re-evaluate your Dental and Vision plans. Are they really saving you money? Research the actual out-of-pocket prices of dental and vision care with what you are currently paying in annual insurance payments.

The vision care industry has been disrupted recently, making vision care much cheaper. Increasingly, people are buying their lenses and frames online through Warby Parker, GlassesUSA, and EyeBuyDirect. Eye exams are about $75 at Walmart and JC Penney.

Total Potential Savings on Insurance up to $1,000 over the next 12 months

#27. Take the Senior Discount!

Assuming you are older than 50, you're eligible for special treatment. Many discount programs start earlier than most people think. Don't be embarrassed to take the discount, you earned it!

Step one, go to theseniorlist.com to see the full array of major discounts currently available. Most restaurants offer a 10% discount for age 60+. Denny's stands out, offering a 15% discount to AARP members. Uno Pizzeria offers a 25% discount on Wednesdays.

Retail savings are also available. Walgreens offers 20% off once per month. Ross, Goodwill, Bealls, DressBarn, and TJ Max all offer at least 10% on certain days of the week. The AARP Prescription Discount Card is a must.

Budget and Alamo car rental offer 10-25% discounts. Hyatt has the most aggressive discount in the hotel sector. Most hotels discount 10%, but shop around.

A Lifetime National Parks Pass (U.S.) is only $80--a must if you travel. Cell phone plans discount 10-15%, but shop around (Google Fi, Mint Mobile and other discount carriers).

Total Potential Savings up to $600 over the next 12 months

#28. Tame the Electricity Beast!

Identify all of your electricity hogs and develop strategies to deal with them. The average American home pays about $100-$130 per month for electricity. By making a few changes, you can save 20% on your bill over time.

Turn off the lights when you are not in the room. Replace your air filters every 3 months. Cook using a countertop appliance. Add a couple ceiling fans. Change burned out lights with energy-efficient alternatives. Reduce all major air leaks around the house. Buy a programmable smart thermostat to reduce energy consumption when you are not at home. Run the dishwasher and washer-dryer when you have full loads. Set your water heater to no more than 140 degrees Fahrenheit. Dress warmer in the winter.

Total Potential Savings up to $300 over the next 12 months

#29. Hire a Good Accountant for Your Taxes

Assuming you own a home and actively invest in the market, it pays to have an accountant file your taxes. The tax code is constantly changing, and it's easy to make a significant mistake. A recent survey of over 2,000 tax payers showed that self-filers, on average, received an $1,800 refund vs accountant-filings who received on average $2,600. Paying $300-350 for accounting services still leaves almost a 30% increase in your refund. You also have the peace of mind knowing the accountant will help defend you in an audit.

Total Potential Savings up to $500 over the next 12 months

#30. Choose Your Bank Wisely

The wrong bank can be costly to your bottom line! Choose a bank with a national network and a strong affiliated global network. Banks are notorious for their fees--ATM, overdraft, monthly account, transfer, and currency exchange. The average American pays about $330 in fees per year.

Find a bank that has the biggest reach, requires the lowest balance, and is sparing in charging extra fees. Capital One 360 and Schwab Bank rank very high on our checklist--both online banks. There are no monthly fees or minimum deposit requirements. They have strong networks and reimburse for global bank ATMs. Private ATMs will still have fees.

For savings, it may still be preferable to use Worthy Bonds at 5% interest--hard to beat.

Total Potential Savings up to $320 over the next 12 months

#31. Actively Manage Subscriptions and Memberships

An audit of your subscriptions and memberships is a must for a disciplined budget. Take control with the Truebill app. Step One, review monthly credit card statements and identify all subscriptions and memberships. Step Two, cancel all subscriptions and memberships you don't need! Step Three, actively manage the remaining subscriptions.

Where possible, share streaming media subscriptions, e.g., Netflix. Use trial periods to your advantage. Rotate your streaming media subscriptions, e.g., Netflix, Showtime, and HBO (Max), when your favorite shows start new seasons.

Be careful of software subscriptions! Buy the software upfront instead, e.g., Adobe and Microsoft products.

Indoor fitness memberships can really add up over 5 years! Consider running or joining an outdoor community club.

Total Potential Savings up to $600 over the next 12 months

#32. If You Have Hair, Save Money on Maintenance

Hair styling and grooming don't have to cost a fortune. For most men, short hair is easy--buy a pair of decent hair clippers and enjoy years of saving!

For those requiring styling, network with friends to find a reasonably priced skilled hairstylist.

Adopt a style that is easy to manage, cut you own bangs, touch up your own roots, don't buy products at the salon, and skip the wash & style. After a few months, this will all come naturally.

Total Potential Savings up to $400 over the next 12 months

Let's Start Building an Itinerary!

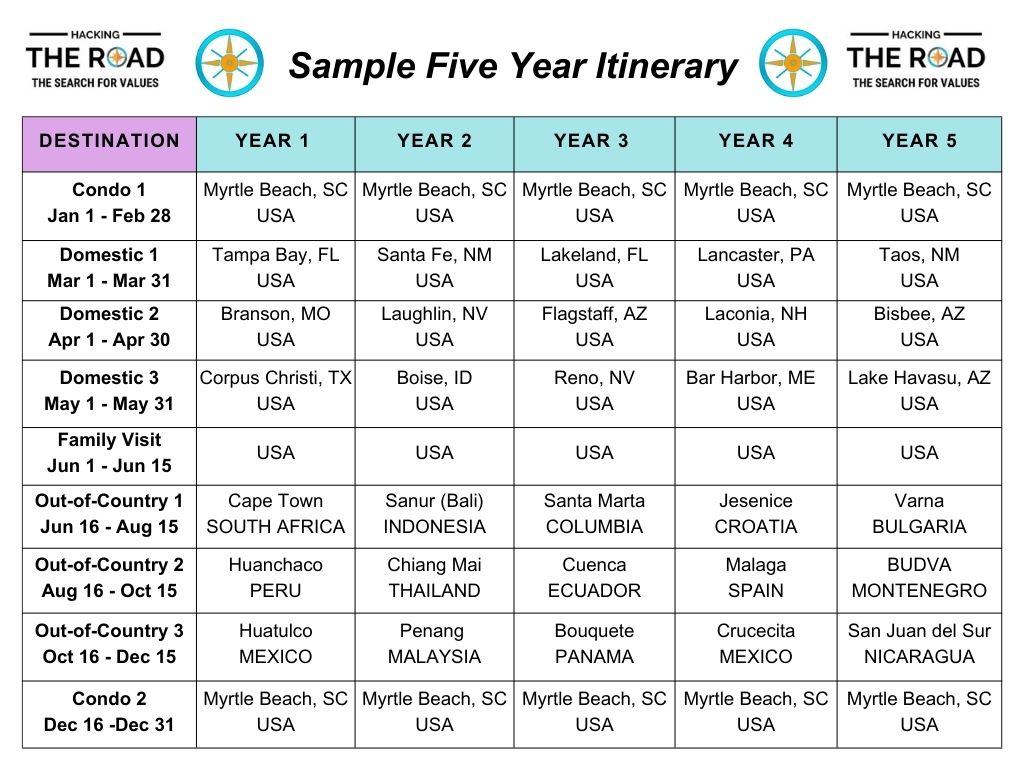

The Building Blocks of Our Model 5-Year Itinerary

As promised, this is where we share our Model 5-Year Itinerary.

Use this model to start crafting your own travel flow. This will give you an idea of how your plan might work when finally in motion. The complexity of the inter-locking parts needs to be tested on paper before you hit the road.

Our first step was to build a prototype annual travel framework. The framework was important for itinerary planning and served as the basis for creating a realistic long term budget.

The timing for the different itinerary segments was one of the most important considerations.

The following outline shows a general timeline for each of our major travel categories across one year:

This gave us a practical framework for our more detailed travel design.Your budget and travel preferences will impact the design of your framework.

Here are some of the other factors that informed our design:

It is likely that you will be over budget in some categories. Don't panic! Just make sure you offset these overages elsewhere in your budget. As long as you actively manage your budget, there's nothing to worry about. Passive engagement here can be a negative. You will have tough choices.

Let's Create a Sample 5-Year Itinerary!

We have developed a sample 5-year itinerary framework based on the above design guidelines.

Keep in mind, this is just a model--a guide for planning purposes only.

The framework is made up of 4 major categories of travel--Condo (visits to our condo in Myrtle Beach); Domestic (3 new US locations for at least 1 month each); Family Visit (our annual visit with family); and Out-of-Country (3 new foreign locations/year).

The itinerary chart included below is organized chronologically (January - December)--and is sub-divided into the following sub-categories:

The chart below includes sample locations that might be grouped together for each or the 5 years.

Note: "OOC" is used to abbreviate "Out-of-Country" below.

A Closer Look at the 1st Year

The Model for our First Year on the Road

Let's take a closer look at our first year on the road. A 1-year Model Itinerary follows:

Note: The model below does not include our 2-week Family Visit (June).

Condo 1 & Condo 2: Myrtle Beach SC (December 16 - Feb 28)

Our domestic Condo 1 and Condo 2 stays might begin in mid-December and extend through the end of February each year. This is our time to decompress and refuel for the next year of full-time travel.

Veteran full-time travelers almost universally recommend having some kind of permanent home base to fall back on each year.

We use this stay to get all of our more complex annual tasks done--filing taxes, car registration, annual insurance payments, storage management (retrieving items and payment), checking in with our retirement system, making decisions on our banking and credit card vendors, and, of course, having some fantastic South Carolina BBQ!

Budget Impacts:

Domestic 1: Tampa Bay FL (March 1 - 31)

Our 3 months of domestic travel starts with a visit to Tampa Bay (FL). We try to pick destinations that are reasonably priced with proximity to interesting sights and excursions. Good weather is also an important factor. Florida has wonderful temperatures during the winter months.

Tampa has plenty of reasonably priced accommodations on Airbnb and Vrbo. You can't go wrong with RV and Camper Parks either.

From Tampa, you have easy access to Disney World, Daytona Beach, Crystal River (manatees!), Cedar Keys, St. Petersburg, the Space Coast, Sarasota, and Mt. Dora. Overnights might include trips to St. Augustine, Miami, and the Keys.

Budget Impacts:

Domestic 2: Branson MO (April 1 - 30)

With the weather starting to improve, we're off to Branson Missouri. You will be more than impressed with Branson and its surrounds. Originally, Branson was known for its country music shows and family entertainment.

Today, Branson offers a diverse selection of shows every day of the week; featuring illusionists, stampedes, musicals of all genres, and top-name comedian acts.

Branson also has a great aquarium and very entertaining interactive museums and exhibits for hours of fun. Adventurists will enjoy visiting the Shepherd of the Hills Experience for zip lining. Branson has some of the best trout and bass fishing in the United States. Don't forget the BBQ!

Budget Impacts:

Domestic 3: Corpus Christi TX (May 1 - 31)

Time to head back to the beach in Corpus Christi (TX). The waters in the Gulf of Mexico are always beautiful and the temperatures are nice this time of year (lower humidity). '

Why Corpus Christi? The beaches around the bay are wonderful and there are lots of easy day-excursions.

Locally, explore the Padre Island National Seashore, the Texas State Aquarium, and the aircraft carrier The USS Lexington.

San Antonio's River Walk and the Alamo mission museum are a must only two hours away. Houston and NASA's Space Center are 3 hours away. For the more adventurous, New Orleans is an 8-hour drive for an overnight you'll never forget!

Budget Impacts:

Out-of-Country 1: Cape Town, South Africa (June 16 - Aug 15)

It's winter in South Africa, but this is one of the best times to see wildlife. The Kruger National Park is hands-down one of the best places to see the Big Five game animals in their natural habitat.

If you have a little extra cash, a flight to Namibia to see the expanse of wild animals at the watering holes in the Etosha Pan Reserve is more than worth the expense.

The Western Cape is full of adventure! Start with a thorough tour of all the beautiful coastal suburbs of Cape Town. Then, it's time to venture up the east coast. Hermanus has tremendous whale watching opportunities. Gaansbaai has some of the best shark cage viewing in the world.

Wine enthusiasts will be exhausted traveling around the wine farms scattered around Stellenbosch, Somerset West, the Elgin region, and Paarl.

Venturing further up the east coast is also well worth the trip! The drive through the Knysna Garden Route and a visit to the Cango Caves near Oudtshoorn will fill you with great memories. South Africa is also famous for its braai culture--a tasty South African version of BBQ!

Budget Impacts:

Out-of-Country 2: Huanchaco, Peru

(Aug 16 - Oct 15)

Huanchaco has it all--surfing, boogie boarding, fresh seafood, ancient pre-Inca ruins, and amazing ocean views. And ... it's really affordable. Huanchaco lies on the far northern coast of Peru.

Temperatures are great year-round. For the history buffs, visit the pre-Inca Chan Chan archaeological site very close to Huanchaco.

Peru has so many great locations and sights to visit. You will love the food, the people, and the music. If you want to experience southern Peru, you might want to stay in colonial Arequipa. The city is surrounded by mountains, including 3 volcanoes.

Both Huanchaco and Arequipa are just a short flight to Cusco, Machu Pichu, and the amazing Nazca Lines. These excursions will cost a bit, but bucket list excursions are well worth the investment!

Budget Impacts:

Out-of-Country 3: Huatulco, Mexico

(Oct 16 - Dec 15)

Huatulco is the perfect spot if you love pre-colonial Mexican culture, fresh seafood, snorkeling, diving, nature reserves, ancient ruins, fishing, and drop-dead gorgeous beaches! Who wouldn't love that combination? You'll be here for 2 months, but you'll be very busy!

More than half a million indigenous people live in the general area. Mixtec and Zapotec culture is ingrained in everything--food, music, dress, artisan creations, and much more.

Huatulco boasts at least 9 large bays, each with their own beautiful beaches (32 in all)--the most accessible being Santa Cruz, Chahue, San Augistin, and Tangolunda. Some of the best bays are only accessible by boat--but worth it!

Also, don't miss the Bahias de Huatulco National Park and the Hagia Sofia Ecological Reserve for their stunning beauty. The Eco-Archaeological Park of Copalita is only ten miles out of town. The standard of living is modern and relatively cheap.

Budget Impacts:

Don't Forget About Airfare Expenses for the First Year

Your biggest travel budget item will be airfare!

We tend to book our air fares for the whole year upfront. That's quite a puzzle, but can save you significant amounts. Booking as you go does allow for more flexibility, but prices fluctuate and some countries require proof of an air ticket leaving the country.

KAYAK, Skyscanner, and Agoda are a good place to start for the actual bookings. Make sure you check regional discount airlines in case they don't make the search. We use AirTreks planning tools to get a general sense of the feasibility of our plans.

Budget impact for the first year itinerary as described above:

Time to Tie up all the Loose Ends!

Final Strategies and Planning that Need Attention

Disclaimer ... Again! Please be sure to consult your Financial Advisor and/or your Health Professional in all matters affecting finances and/or your health. Circumstances and realities vary significantly from person to person. The following strategies simply represent goals and strategies we have developed based on our own experiences.

As we put the final finishing touches on the Longterm Travel Plan, let's take a look at three areas that might still need some discussion and planning:

Here's our take on these important categories:

Remote Working

This section focuses on possible remote job strategies that will fit your eventual Life on the Road.

There are a lot more options than you would expect. COVID has fundamentally transformed the workplace to be more remote-friendly.

Targets to Explore: Your existing job might have remote assignments; consulting presents increasing remote opportunities; selling goods & services online is all remote; teaching online is one of the most popular remote gigs; and, don't forget, there's always remote contract work online.

Set your goals for how much you would like to earn each year, and figure out what that will take in your chosen field. Who knows, you might even be able to get partial health benefits.

Research and planning will go a long way to better position you for your ideal remote strategy. Remember, if both partners work, you don't have to earn as much.

A few of our remote job Pro Tip Strategies follow:

Assess Skills for Remote Jobs

Determine which remote jobs you would like to target and assess your skill level. Ideally, you would have the skills necessary to be gainfully employed in your chosen field.

Your best case scenario would be to negotiate a part-time remote job with your most recent employer. Skilled and experienced employees are hard to replace.

You would also be viable for remote consulting or contract jobs in your industry.

Hobbies that can be monetized online are your next best opportunity. Clearly, you already have the skills for success!

Need More Skills, Get them!

You need to take the time to acquire new skills, update existing skills, and get certified for new remote jobs. Teaching presents a huge opportunity.

Teaching English-as-a-Second Language (ESL) requires a bachelors degree and TESOL/TEFL certification.

Teaching college online usually requires a masters degree and some in-class teaching experience. Teaching at a local community college would satisfy this requirement.

Technology for Remote Work

Computers, WiFi routers, cell phones, and the most popular productivity software are all required tools of the trade.

Make sure you have reliable tech. Apple products tend to be pricey, but they are reliable and have trade-in value when you upgrade. If you work in education, get the discounts!

Digital Storage

This section focuses on developing a long range plan for keeping your information secure and accessible from anywhere in the world.

How difficult can it be to digitize your life? Very difficult! This is a tedious, time-consuming task that has a huge pay-off at the end. Part of getting ready for a Life on the Road is getting your digital life under control. This means you need to determine what "information" needs to be accessible.

You should ideally have access to all your key documents (paper and digital), photos, videos, and music. That's a tall order, because it means you will have to locate and convert all your content into digital format and upload all that content.

Organizing your uploaded digital files for easy access is also an important part of the overall process. This all takes time, but well worth it once finished.

It's truly freeing to know that we have access to all our important information whenever we need something. We also don't have to worry about our computers crashing!

A few of our digital storage Pro Tip Strategies follow:

Choose a Cloud Storage Option

Step one is to decide on a cloud storage vehicle that can satisfy your requirements--and not bankrupt you. We considered the following providers: iCloud, MicroSoft OneDrive, Google Drive, & PCloud.

They're all very good options, but we chose PCloud based on excellent reviews, reliability, and outstanding value. We were able to get a life-time subscription to 4.1 Terabytes of storage for a one-time payment under $650. That's a lot of storage at a generous price!

Digitize Older Content

Converting old paper photos and documents into digital content was a time-consuming job. We bought a specialty photo box with LCD lighting customized for taking photos with our iPhone.

Cassette audios and VHS videos can be recorded on your iPhone and made available for digital upload. You can save time by having a vendor do the conversions, but this can get quite pricey.

Organize & Upload Digital Files

The final step is to locate & organize all of your existing digital content and to start uploading your life to the cloud!

Locating all your digital files sounds simple enough, but we had quite a time doing just that. Our digital footprint was scattered over several devices and cloud storage areas.

Once located, we had to organize our files for easy access once uploaded. Now that it's all done, it's all gravy! And we have instant access to every photo that used to be stored away in boxes, rarely to be looked at again!

Healthcare Needs

Before making any decisions related to Healthcare, please consult your Health Professional first!

This section focuses on possible long range strategies to address your healthcare needs on the road. The two biggest obstacles for most aspiring full-time travelers are finances and healthcare insurance.

Healthcare is particularly difficult for Americans dreaming of a Life on the Road. The costs are prohibitive and network coverage can be limiting. Out-of-country travel just adds to the apprehension.

So, what does one do in the gap between leaving your full-time job and the day your retirement insurance (age 60) and/or Medicare (age 65) kicks in? There are no easy solutions here, but you do need a plan.

We've done a lot of research on this matter. All we can do here is describe our experience. Our gap strategy is not ideal--and not for most people. It involves some creativity, cobbling together a few buckets of coverage that we can afford.

We self-pay for all doctor's visits, labs, vaccinations, and prescriptions. Be sure to let people know you don't have health insurance--this helps contain prices.

We also have World Nomads Travel insurance that covers us for most medical emergencies anywhere in the world 90 miles or more away from home.

For more serious health issues, we plan to evacuate to Malaysia or South Africa--a medical tourism strategy. Both countries have outstanding western-trained medical staff and unusually low prices.

It's not the most secure plan, but it is the best possible plan we can afford. If this makes you nervous, you could opt for Integra Global or IMGlobal for traditional health coverage.

Also consider health plans in each country you visit. Many in-country plans are very affordable.

Understand Your Healthcare Gap

As we prepared for our Life on the Road, healthcare insurance became a big concern. We were in our mid-50s and deep in the uncomfortable gap before our State Pension health insurance kicked in at 60, and a long way from Medicare at 65.

Unfortunately, we still earned too much to qualify for cheaper health insurance under the Affordable Care Act. Our only real option was to take the risk and cobble together some form of coverage using self-pay, travel insurance, local insurance, and medical tourism.

If you are lucky to have State or Medicare insurance, you're fortunate. Just be sure to consult an expert before declining coverage to avoid longterm coverage issues.

Our Gap Plan for Healthcare

Our healthcare approach:

Other gap possibilities: Integra Global and IMGlobal are a little more expensive, but provide traditional health coverage worldwide.

Be Healthy: Exercise, Eat Right

The best insurance policy of all is the common sense of exercising and eating right. Neither of us smoke or drink alcohol on a regular basis. Rainman runs ultra-marathons and Tricia is an avid swimmer and exercise walker.

We eat healthy, favoring a mostly vegetarian Mediterranean diet. Our biggest unhealthy weakness is probably too much cheese in our recipes and, of course, a lot of ice cream! Healthy snacks are a must.